Does your RIA have the tools and information you need to succeed?

RIA custodians are more than technology and service providers – they are stewards of data.

Performance data, demographic data, trading data – everything feeds through the custodial service provider in one way or another. In recent years, some RIAs have started to question if their RIA custodians should really be the exclusive owners of that data.

There is a growing trend of advisors accessing this data from their custodians and storing it internally at their RIA. This move can help advisors to leverage data analysis to unlock new insights on their business and ultimately create potential growth opportunities.

The questions advisors need to ask themselves: What data can I access? How is that data delivered? What can that data do for my RIA?

What Data Can You Access from Your RIA Custodian?

Before identifying what a RIA can do with their data, they need to figure out what data they can actually access.

Each RIA technology vendor has its own unique set of data policies and procedures. These policies address points like data storage, redundancy, and security protocols. While these policies may be in place primarily to protect clients, they can sometimes extend beyond security concerns and ultimately create barriers for RIAs looking to leverage this data.

Some RIA custodians, for example, severely limit the data that they share with advisors. These limits may be based on cadence (only sharing data at certain times of day/periods in a month), types of data points (restricting what kinds of data RIAs can retrieve), or data formats (only sharing data in a raw, relatively unusable format).

Additionally, these RIA custodians may look to sell some of that data. While these firms may look to limit exposure of personally identifiable information (PII) from those data sets, it can still create a potential conflict of interest if a RIA’s provider is profiting off their data.

Other RIA custodial service providers, like TradePMR, have a different philosophy. These firms believe that RIA data is just that – the RIA’s data. TradePMR invests the time and resources to ensure that the firm can deliver data that advisors want, when they want it, all while maintaining strong security protocols.

TradePMR also firmly believes that it does not own RIA data, and as such will never sell that data to third parties. The firm is focused on supporting advisors through strong technology and support, not profiting off of them through back-alley deals with outside vendors.

TradePMR’s Investment to Deliver Data

TradePMR is focused on supporting advisor growth 100% of the time. TradePMR sees RIA firm data as yet another avenue to support that growth.

The biggest advisory firms in the industry have been leveraging data for more than a decade to influence their portfolio management, client relationships, and overall business direction. TradePMR believes that these insights should be available to all RIAs, not just the industry’s biggest firms.

Beyond committing to sharing data with advisors, TradePMR focuses on sharing structured, usable data.

Structured vs. Unstructured Data

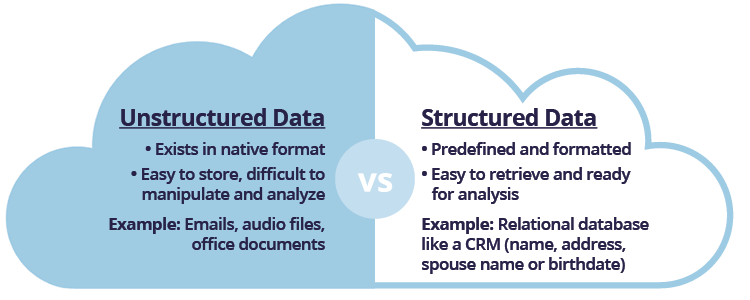

For many RIA custodians that are willing to share data, they may only share that data in an unstructured format.

Unstructured data is data that exists in its native format. This is raw, unsorted information and can include items like emails and office documents, as well as video and audio files. This data is easy to accumulate and store but can be difficult to analyze without a significant investment.

Structured data, on the other hand, has been predefined and formatted into a set structure before being shared and placed into data storage. A good example of structured data is a relational database, wherein data has been formatted into fields like name, address, and birthdate. This information is easily reviewed, sorted, and leveraged for analysis.

Advisors are not data scientists, but that doesn’t mean data can’t have an impact on their firm. With structured data readily available, advisors can get a clearer picture of their client base and overall business. If a RIA only has access to unstructured data from their custodial service provider, they could have a hard time putting that data to work.

Data to Support RIA Growth

Having access to comprehensive structured data from a firm’s custodial service provider can help that RIA drive the future of their business.

Without a deep knowledge of database technology, advisors can easily manipulate and search through this data. It’s relatively simple to analyze and can provide some immediate insights into a RIA’s business. Easily searchable RIA trading data, for example, could help to illuminate sectors or securities where a client portfolio may be overconcentrated.

For advisors looking to dive in deeper with the help of a technology-focused team member or outsourced data analyst, this structured data can provide even more direction for a growing RIA. The data can be analyzed using formulas from a range of advanced technologies on the marketplace. These technologies can review massive datasets in a matter of seconds, identifying successes and areas to improve within the business.

Beyond these formulas, RIAs can even leverage machine learning to unlock deeper insights into their businesses. These insights can help to identify behavior patterns among clients and can suggest next best actions for the firm.

Don’t Get Held Behind by Your RIA Custodian

The ways that data can influence everything from operations to client advice are expanding rapidly. With the biggest firms in the industry leveraging data, don’t let your RIA fall behind because of limited data access.

If you’d be interested in hearing more about TradePMR’s approach to data and how data could help power the future of your business, we should talk.